Here at ElectrifAi, we spend a lot of time talking to customers and prospects. We learn what’s on their mind, what keeps them up at night and what their industry pressures are. This POV episode is about unsecured lending.

Unsecured ending typically consists of:

This list extends to other lending products not secured by some type of asset or collateral. It tends to be a higher yield financial product in terms of interests and fees charged but, also by its nature, has a higher ratio of defaulting lenders.

The overall profitability comes down to the interested income earned on the loans vs. the rate and extent of defaults on a percentage of the loan book.

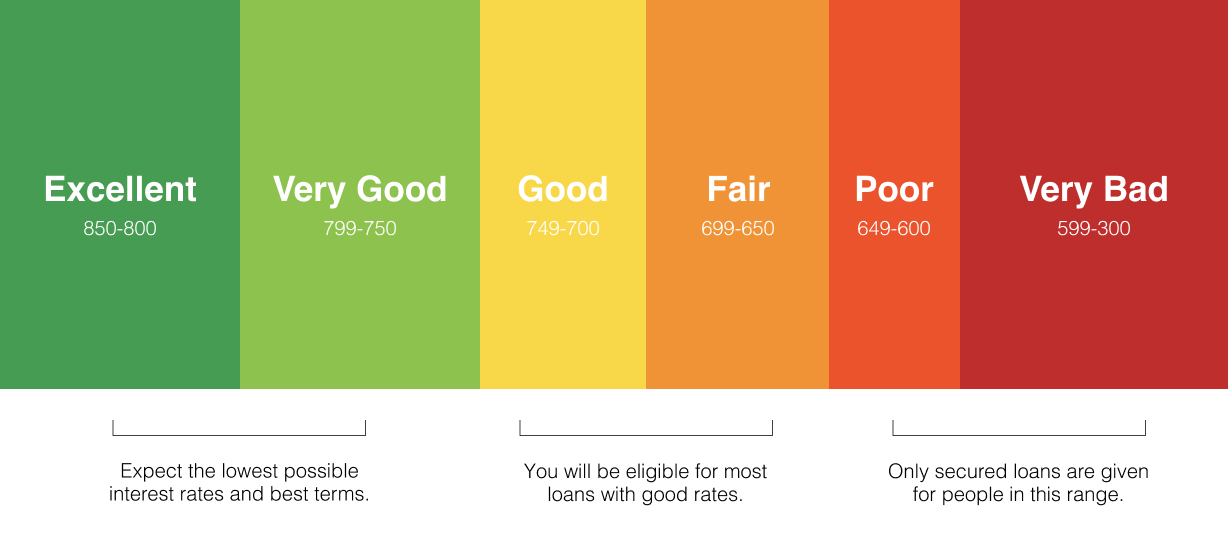

Most lenders try to mitigate that risk by focusing on and marketing to higher quality borrowers (i.e., those with a credit score in the 800-850 or 750-799 range).

The challenge with this approach is most mainstream lenders target the same group and that results in a very competitive market, the need to offer incentives like 0% balance transfers, frequent travel programs and other perks. This part of the market tends to be very saturated to any progress adding customers is a game measured in inches. The amount of consumers with excellent credit scores is limited and, as a result, so is that pool to fish in. The margins on the lending also aren’t great.

Ideal outcome would be to move further down the credit score scale into the 700-749 (good) range or the upper part of the 650-699 range (fair). Lenders can charge more interest to these groups due to their higher risk so in theory the loans are more profitable, provided the borrower doesn’t default.

Therein lies the challenge. How to identify the lowest risk customers in those lower credit quality groups to get good interest yield on your loan products without the corresponding increase in default behavior?

Like so many things in life the answer is not black and white, and the answer could be figuring out what’s in the gray area between them. There could be a multitude of factors that go into a person’s credit behavior, and they could be very diverse. For example:

Being able to aggregate and crunch all this data is likely to yield patterns and insights into a borrower or potential borrower’s behavior over time and more accurately predict their risk of default over time.

If the lender can figure all this out, they can expand their net to other borrower groups where they can segment those borrowers into more fine-grained segments that will pay more interest than a full prime borrower but are much less likely to default and thereby become a loss over the longer term.

Keep in mind that avoiding a default not only saves the profit on the loan and the loan capital itself but also the cost of trying to recover a defaulted debt (i.e., collections costs, legal costs, losses from sale to a collections agency).

Our experience with lenders on advanced credit decisioning products leads us to assert that the best way to identify a lower risk borrower in a lower credit score tier is to evaluate more data points than just a credit bureau or FICO score.

The only viable way to crunch that amount of data from such a diverse range of data sources is to use machine learning . Even with the best BI tool in the world, humans are limited by how many dimensions of data they can process and understand, typically 5-7. Machine learning can process hundreds and thousands of dimensions and spot credit patterns, behaviors and anomalies that would normally have lain undiscovered by the human eye.

Thus, our point of view here is to widen your sources of data both 1st and 3rd party and use machine learning to identify and refine the patterns used to identify higher interest/low default prospects from higher interest/higher default prospects. Then use that data to build precision marketing campaigns to target the higher interest/lower default segments.

If you are ready to begin using machine learning to enhance your data sources, contact us today and we will reach out to you promptly.